What Is The Gold Silver Ratio?

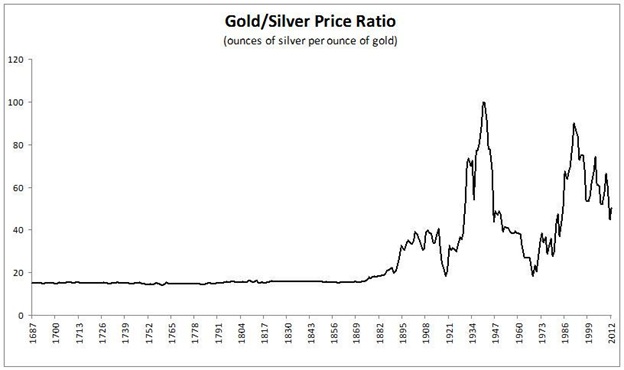

As of April 2nd 2014, the Gold/Silver ratio stands at 64:1. This means that it takes 64 ounces of silver, to purchase one ounce of gold. This ratio offers some historical insight and some believe that it offers future insight into the direction of the price of silver.

Prior to 1900, the Gold/Silver ratio fluctuated mildly around 16:1. This was because gold and silver prices were routinely fixed and as a result, the ratio was fixed as well. Since then however, commodity prices have been traded on the open market and as a result the Gold/Silver ratio has oscillated wildly from as high as 100:1 to as low as 17:1 during silver’s peak in 1980. In 1991, the ratio peaked at just over 100:1 and has been on a downward track towards 32:1 when silver came just shy of $50 per ounce in April of 2011.

Why is this number argued over?

There are many arguments in the gold and silver community over where the ratio should lie. There are purists who believe that the ratio should return to it’s historical level of 16:1. With a gold price of around $1,300 dollars today, that would put the price of silver at roughly $82 dollars per ounce. However, there is a group that cites a study where the rarity of gold and silver on the earth was analyzed and it determined there was 19 times more silver in the earth than gold. If silver were priced at 19:1, that would put it’s per ounce price at $68 dollars. Conversely, there is yet another study that pegged the occurrence of silver to gold in the ground at a 9 to 1 ratio. This would cause a silver price of $144 dollars. You can see that this is quite a range.

Given that historically, silver has had a much lower ratio than today causes much confusion. The current ratio of 64:1 is nowhere near the 9 – 19 ratio suggested historically as well as naturally occurring in nature. Assuming that the ratio returns towards its historical mean of 16:1, that would suggest that buying silver would be favored over buying gold.

In 2011, the annual global production of gold stood at 2,618 tonnes. That same year, the annual global production of silver was 23,688 tonnes. This fits perfectly with the 9 to 1 ratio that is supposed to be found in the earth. However, currently central banks prefer to hold onto gold rather than silver as gold is considered the ultimate store of wealth. But with gold prices continuing to rise and silver having a dual purpose (as an investment vehicle as well as in industrial applications), the future is bright for the white metal. With high debt loads and quantitate easing becoming a staple of western economies such as the United States, Japan and all of the European Union, the Gold/Silver Ratio is on the path to shrinking.