End of the London Gold Fix?

Two weeks ago, for the first time in almost 100 years, the gold market daily price fix is about to change. This move is an attempt to achieve more transparency in the gold market and could provide a clearer picture into China’s voracious appetite for the yellow metal.

Since 1919, the London Gold Fix has been set twice daily by only 4 participants (used to be 5). Because of this limited input from the actual supply and demand of the entire world, there have been allegations of gold price manipulation for decades.

“The changes taking place with the new gold fix could be a game changer for gold trading as we know it,” said Kevin Kerr, president of Kerr Trading International.

The new system that has been put in place by the London Bullion Market Association, dubbed the LBMA Gold Price, is designed to be an electronic system that allows for as many participants as possible in the auction process.

“The new method for fixing the gold price daily will be more reflective of that day’s collective price of gold on the world market,” said Jim Wycoff, senior analyst at Kitco.com.

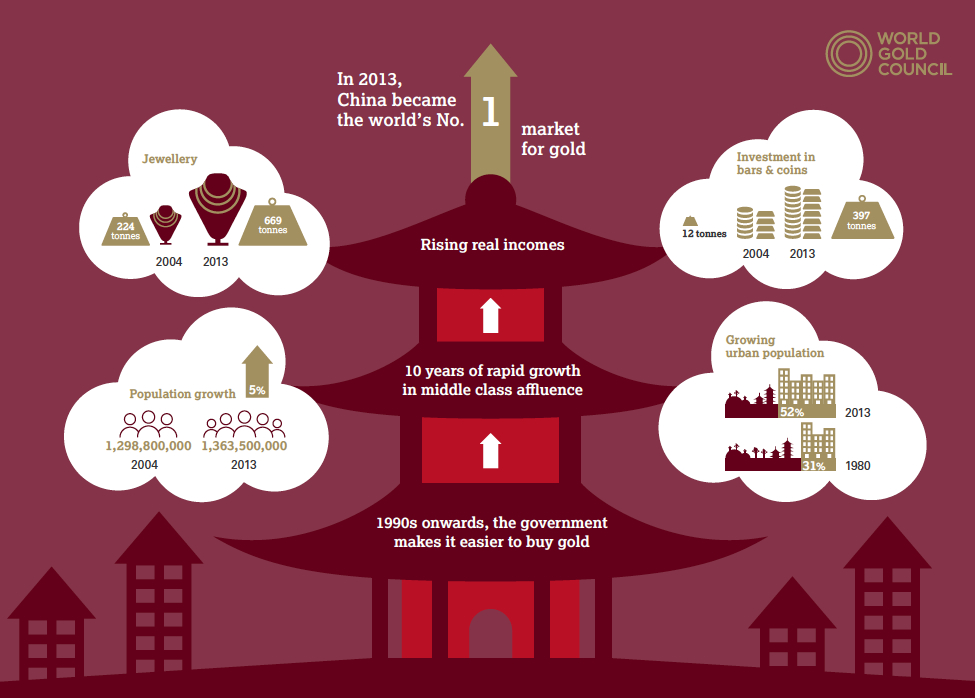

China, the country with the largest appetite for gold (China is the world’s largest gold market), is now expected to participate directly in setting the new gold fix price. In theory, this would allow for a more transparent view of the daily gold inflows and outflows of the world’s second largest economy.

If the Chinese banks are directly involved in the daily gold fix then they smooth out the price differences between Shanghai and London which would make it a 24-hour, international market.

Although the new gold fix isn’t expected to affect gold prices in the short term, many in the industry view this as a positive for gold prices as China has been allegedly hoarding tonnes of gold throughout the past 10 years. And with the new system, these purchases would be more transparent and reflected in the price of gold.