What is Pre-1933 Gold?

In the past decade, the term “Pre-1933 Gold” has become commonplace in the bullion industry. Companies have used infomercials, radio ads and email marketing to urge customers to purchase gold bullion that was minted prior to 1933. While there is some merit in owning gold bullion that was minted prior to 1933, many consumers are ill-informed and end up paying exorbitant premiums. Before you decide to purchase any gold bullion, especially Pre-1933, you should at least have the facts in front of you to make a well-informed decision because it’s easy to get sucked in by scare tactics.

What Happened In 1933?

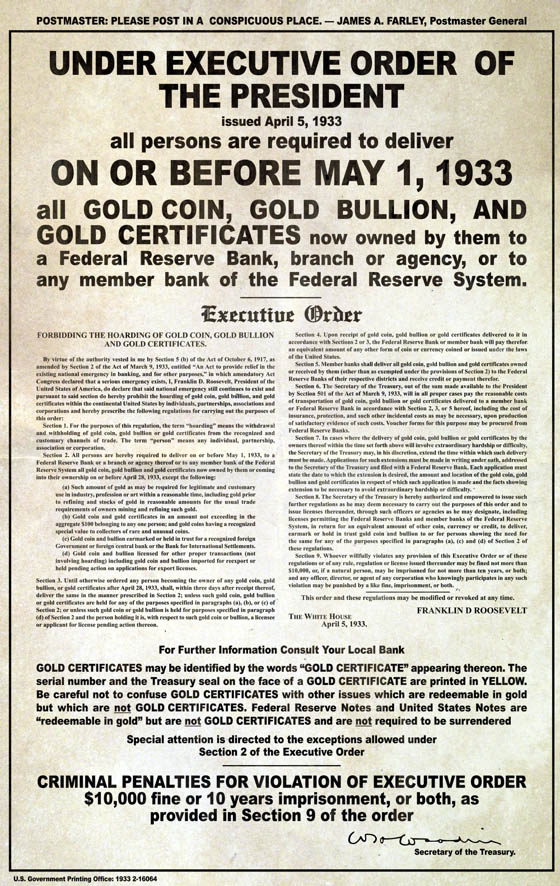

On April 5, 1933, President Franklin D. Roosevelt signed Executive Order 6102 which forbid “the Hoarding of gold coin, gold bullion, and gold certificates within the continental United States.”

Executive Order 6102 allowed citizens to store up to $100 (face value) in gold coins, or up to roughly 5 troy ounces. Any gold bullion, gold coins, and gold certificates in excess of that amount was required to be delivered to the Federal Reserve in exchange for $20.67 per troy ounce. Failure to comply with the Executive Order was punishable by “$10,000 and/or up to five to ten years imprisonment.”

It’s worth noting that not one U.S. citizen was ever convicted for not complying with the executive order, even though only around 25% of privately held gold was turned in.

Why Was This Order Enacted?

The stated reason for enacting Executive Order 6102 was that in the midst of the Great Depression, hard times had caused citizens to hoard their gold, which was stalling economic growth and exacerbating the depression. All of the gold that was turned in to Federal Reserve banks was melted down into 22 karat bars and moved to Fort Knox. This was to ensure the viability of the dollar and keep it entrenched as the internationally convertible gold standard currency.

The Exemption Clause

In Executive Order 6102 there is a clause that many gold dealers at the time focused in on which exempted “gold coins and gold certificates in an amount not exceeding in the aggregate $100 belonging to any one person; and gold coins having a recognized special value to collectors of rare and unusual coins.”

It’s this clause that protected recognized gold coin collections from government seizure and likely melting. But the “rare and unusual coins” clause also allowed people to skirt the order/law and justify not turning their gold in to the government. Ironically, it’s this clause that also gave rise to the promotion of pre-1933 gold by many T.V. talking heads during 2008’s election cycle.

Will My Gold Be Confiscated?

While you can’t put anything past the government, the likelihood of a mass gold confiscation is extremely low, and possibly nonexistent now that the United States is no longer on the gold standard (Richard Nixon took the United States off the gold standard in 1971). However, in the event that there is some global crisis that prompts the United States to enact a gold confiscation, there is no guarantee that coins which hold numismatic value will be exempt. Companies and infomercials that are pushing pre-1933 gold are banking on the idea that if there was another gold confiscation that the government would reuse the stipulations from Executive Order 6102. There have been 172 Executive Orders under President Obama so far (since 2009).

Layers of Cost

When purchasing a pre-1933 gold coin, be aware that there are 3 layers of cost built into the price of a numismatic coin: the metal content, the numismatic premium and the dealer profit. Because these coins are no longer in production and since many were confiscated and possibly melted, their rarity is inflating their numismatic value.

This is in contrast to straight bullion coins and bullion bars which only have 2 layers of cost: the metal content and the dealer profit.

If you do decide to purchase pre-1933 gold coins, keep in mind that they will always carry a higher premium than modern gold coins.

I am interested in using your picture of the gold coins. Any thoughts?