Understanding Silver Prices

-

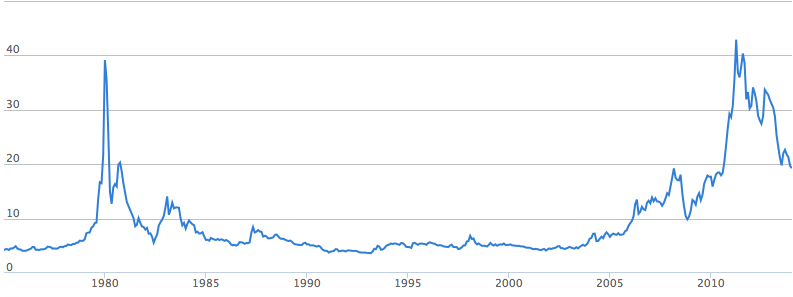

30 Years Of Silver Prices

Introduction

Silver is not only the most malleable and conductive metal you can find but it is also the whitest one. Throughout the history, silver has been used for a variety of application, the most prominent of which is in making jewelry and money. The first evidence regarding the use of silver dates back to 700 B.C.E in present day Turkey. Silver has also adorned tombs from China to Chaldea. Once, it was among the main movers of the European history after discovery of the New World.

Although silver is less rare compared to gold, there is no denying that it has played a critical role in affecting world currencies. It has also consistently moved in the same direction as gold prices. The name of British pounds was coined at the time when one British pound had the value of a pound of sterling silver. Today, more than 14 languages use money and silver interchangeably. In fact, before the Civil War, the U.S dollar used to be backed by silver.

Silver as a Tool of Investment

Just like the other precious metals, silver may is often used as a tool of investment. For over 4,000 years, silver has not only been seen as a type of money but also as store of money. Since the silver standard came to an end however, the metal has relinquished its place as legal tender especially in most of the developed countries, and this even includes the US. However, there are certain countries that mint collector coins and bullion like American Silver Eagle. As of 2009, silver was mainly demanded for industrial application (40%), bullion coins, jewelry as well as exchange traded products. By the year 2011, there was a total of 530,000 tons in terms of global reserves of silver. Each year, investors purchase millions of American Silver Eagle and Canadian Silver Maple Leaf for investment.

At $5 per ounce, Silver Maple Leaf is a legal tender and there are also several other silver coins that have an even higher value of legal tender, which even includes $20 Canadian silver coins. In Utah, silver is legal tender and it can be used for paying virtually any debt.

Usage of Silver

One of the things that determine the price of a commodity, including the price of precious metals, is industrial usage. Silver is used extensively in the manufacture of a lot more items then you can imagine. It can be used to make car parts and even computer parts, which goes to show that silver is so critical.

Apart from industrial usage, the other thing that influences the price of silver is the jewelry. If there is a lot of demand for the metal, its price is certainly going to go up. On the other hand, if there is little of no demand for silver, you can expect that the silver prices will either remain flat or, worse, drop.

Factors Influencing Silver Prices

Buying and Selling of Futures contracts

The futures market refers to a centralized market for sellers and buyers from all over the world who and then sign futures contracts. Pricing may be based on bids or open cry systems and offers and counter offers can be electronically matched. The futures contract specifies the price that will be paid as well as the date of delivery. However, nearly all futures contract without the commodity being physically delivered.

What, specifically, is a futures contract?

Imagine that a wheat producer is trying to find a selling price for the wheat that he will produce next season. On the other hand, a bread maker may by trying to get a buying price so as to know the quantity of bread that he can make as well as what margin. So the bread maker and the farmer may sign a futures contract that requires that 5,000 bushels of grain, for instance, be supplied at $5 per bushel. By signing this future contract, the bread maker and the farmer secure a price which all of them believe will be fair come the time of harvesting the crop. In the futures market therefore, it is the contract, and not necessarily the grain, that gets to be traded.

How the futures market determine silver prices

Futures contracts are what are used to determine silver spot prices. The COMEX, which stands for Commodities Exchange, is the leading platform for futures market. Like many trading companies, COMEX is also headquartered in New York. The trades that happen here are what largely determine the price of silver. When buying and selling of futures contracts takes place here (and indeed around the world), silver prices adjust accordingly.

Futures contracts are utilized in setting silver prices because a big chunk of silver volume traded daily is done electronically and not physically. And because more silver is traded electronically through futures than delivered physically, the futures market offers the most up to date and accurate silver prices.

World Events

Harold Macmillan, the former British Prime minister, when asked by a journalist about what could happen that could steer a government off course, answered ‘Events, dear boy, events!’ The same applies to silver prices.

The price of silver is affected by general economic news. For example, if the Fed (that is the U.S) makes a pronouncement regarding any kind of government policy (this could be general economic outlook, interest rates etc), silver prices are likely to be affected in one way or the other. Silver frequently plays off expected events of the future.

Examples of events that might affect silver prices

- If China persistently sells U.S Treasuries, it would mean that the U.S dollar is slowly demising as the global reserve currency. This would send panic in people who then rush to invest their money in silver not the US currency.

- Any news that affects the global monetary system directly also has a deep and rapid impact on silver prices.

Physical and industrial demand

100 Ounce Silver Bar

Silver demand is what makes silver prices to explode. Roughly two thirds of the demand originates from the industry with the rest coming from jewelry as well as recycling. Only a very small portion represents the demand for silver for the purposes of silver.

Industrial demand

Silver, being an industrial demand, always faces industrial shortage. As a result of production practices and just-in-time stock, the industrial consumers of silver do not have much in terms of silver stock.

More than 70% of silver produced comes about as a by-product of other mining types, like lead, zinc and copper. Simply, the mining industry cannot keep up with the demand for silver.

Therefore, when there is a shortage of silver, the industrial users will rush to beef up their inventories, which mean scrambling for the scarce silver available at the market. This pushes up silver prices. On the other hand, when there is low demand for silver, its price will also go down.

Fluctuation in currency rates

This is another thing that affects the price of silver. When the value of a currency goes down, investors will panic and shift their investment from money value to silver or other precious metals, given that they are relatively stable. On the other hand, when the currency holds strong, investors see a chance to make more money by investing in the money currency and not the precious metal. This makes they do by selling the silver that they have. This creates an oversupply of silver, something that pushes down silver prices.

Other factors that affect silver prices

Private and Institutional investors

In 1997, Warren Buffet bought 130 million to ounces, equivalent to 4,000 metric tons, of silver. The rate was at $4.50 for every troy ounce with the value of the whole purchase totaling to $585 million. Again, in April of 2006, iShares launched silver-traded fund known as iShares Silver Trust and which by exactly two year later, had as much as 180 million ounces of silver as reserves. You can clearly see that large investors can have the ability to affect the silver market prices.

Gold Prices

Gold Bullion Bars

Gold is touted as main force behind silver prices. When the market is bullish, speculators are usually most interested in major precious metals. This leads to increased demand for silver. Given that silver has a market that is comparatively smaller than that of gold it takes just a short time to push silver prices high.

However, in a bearish environment, investors will lose their confidence in silver, something that will cause its price to drop. Also, by analyzing gold-silver ratio trend, it I obvious that silver always follows gold price.

It has been discovered that when prices of gold go up, so do the prices of silver. It also emerged that when the price of gold decreases, the silver price also plummets by a margin that is even bigger. Experts recommend that the best time to buy silver is during a recession while the best time to sell it is during a boom.

Stock Indices

Obviously, there is a strong link between stock markets fortunes and the capital that flows into silver. When traditional investments like stocks are not doing well, silver tends to appeal a better investment portfolio. However, the relationship between S&P 500 and silver is far more complex than merely being inversely proportional.

When you run the regression across leading indices like Dow Jones, BSE, S&P 500 and NSE, a common pattern clearly emerges. The relationship between stock markets and silver was low before recession. However, we clearly saw that during subprime crisis as well as post it, silver highly correlated with stock markets. It shows that the demand for silver investment is returning as market confidence grows.

Oil Prices

Oil, historically, has shown a robust correlation with gold. Also, gold and silver have got a stable relationship. Going by this, it is also logical to say that silver and oil also have a somewhat stable relationship. Others also argue that silver mining is energy intensive, meaning that were oil prices to rise or fall, silver prices would also behave in the same way.

But this would appear an oversimplification since it undermines that there are other factors that also play a role in silver mining. According to another school of thought, silver and oil ought to have a bigger correlation compared to that of silver and gold given that both silver and oil are industrial elements. Therefore, the factors that affect their demand would be common. But whereas oil is a perishable commodity, silver is not.

Oil and silver have had a positive correlation of 0.7, which, while is quite strong, cannot match the correlation of 0.8 which gold and oil have enjoyed. Based on analysis of the relationship between oil and silver, we see that silver tends to have positive correlation with oil especially during secular commodities bull period and secular bearish periods. Our analysis of the silver and oil relationship shows that silver does have a positive correlation with oil during secular commodities bullish periods and the secular bear periods.

Short selling

Uncontrolled short selling has the potential to artificially depress silver price. Short selling isn’t a normal sale, and it is an incomplete or an open transaction. Short selling is also the start of a trading. In the month of April 2007, Commitments of Traders noted that 4 or fewer traders held roughly 90% of the entire short silver futures contracts which totaled to more than 140 production days.

Hedge against financial uncertainties

Like other precious metals, silver can also be used to hedge against deflation, devaluation or inflation. Silver price is affected by present market value of a currency, especially US Dollar. Demand for silver will increase when US Dollar value falls. On the other hand, when the Dollar value strengthens, silver prices fall.

Conclusion

Silver is among the leading precious metals and is valued in the form of a currency and also serves as an industrial metal. In 2006, it grew by a whopping 58%, outpacing its other commodity counterparts like gold and platinum. One of the reason there is such a huge demand for silver is due to the huge investment driven demand that silver currently enjoys. Above are some of the factors that play a crucial role in determining the price of silver. Knowing these factors enable you to know the best conditions to buy as well as sell.