IRS 1099 Reporting – Are Bullion Sales Private?

That is one of the more frequent questions here at Golden Eagle. Customers will call and ask if their bullion sales are “private.” Privacy is of the utmost importance to us as well as our customers and the answer to their question is “Yes. To a degree.”

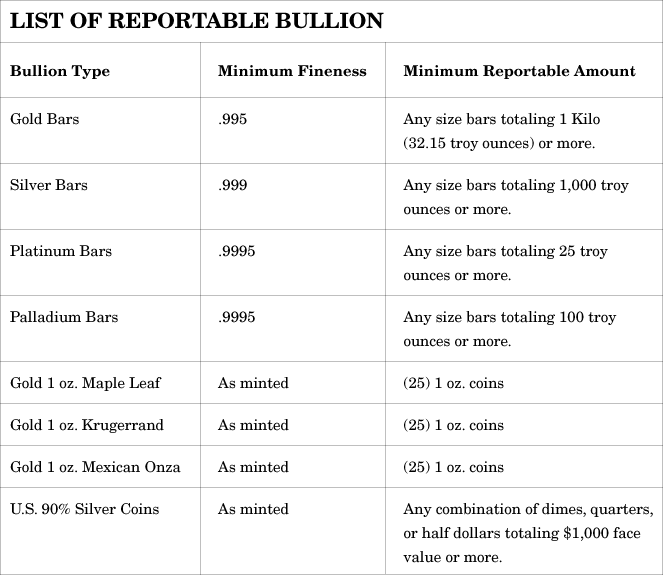

When selling precious metals back to us or any dealer, it’s wise to know the rules when it concerns the IRS. The government requires bullion dealers to file reports when certain thresholds are met. This report is in the form of the 1099B. The following table shows what type and amounts of bullion require an IRS report.

Why is it only these items and why these quantities? The types and forms of bullion that trigger reporting are related to the regulations that are placed on brokers. The brokers are required to report all of the proceeds from stock and bullion transactions. For example, regularly traded items on the commodities exchange used to be 1,000 oz. Comex bars, or 1 Kilo gold bars. This is why the 1099B report is triggered at those levels.

Gold Coins That Do Not Trigger IRS Reporting

American Gold Eagles, American Gold Buffalos and Austrian Gold Philharmonics do not require any 1099 IRS reporting. You can sell as many as you want and no 1099B will be reported to the IRS.

Silver Coins That Do Not Trigger IRS Reporting

American Silver Eagles, Canadian Silver Maple Leafs and Austrian Silver Philharmonics do not trigger any 1099B IRS reporting. You can sell any quantity of these coins as you want and bullion dealers are not required to report it to the IRS.

HOPE EVERYONE ARE DOING FINE. I’VE GOT TO COME VISIT, IT’S BEEN AWHILE. SEE YOU SOON.

i just recieved my order of silver eagles and piece dollar and one goldeagle tenth of an ounce with the date in roman numerals i havent seen that before please explain and what year is it ciao

Gold Eagles minted 1986–1991 are dated with Roman numerals. In 1992, the U.S. Mint switched to Arabic numbers for dating Gold Eagles.

The list above does not mention other forms of silver coin (“rounds”) – at what point(s) they trigger 1099B.

Patti-

“Rounds” are not coins; they are considered bullion, so use the bullion chart for your totals.

CAN I TRANSFER MY EXISTING IRA WHICH IS CURRENTLY IN MUTUAL FUNDS TO A GOLD FUND

Even though a sale might not trigger a 1099, is your personal info taken at the time of sale, such as your name and address or a driver’s license?